The One-Stop Tax Credit Shop

Overview

Taxes can be overwhelming. Filing them can be challenging on its own, but it’s often made more difficult when considering the different components and functions of taxes. The complexity of the tax system coupled with its annual changes deter millions of eligible filers from receiving thousands of dollars in essential financial support. The Tax Credit for Workers and Their Families (TCWF) initiative serves as a source for the latest tools, resources, and knowledge surrounding tax credit research and legislation.

Since 2007, The Hatcher Group has managed Tax Credits for Workers and Their Families (TCWF), a national communications initiative that works to raise awareness of and build support for vital tax credits for low-wage Americans, effectively helping to reduce poverty and improve health and educational outcomes.

Challenge

Established in the late 1970s, the Earned Income Tax Credit (EITC) was intended to strengthen work incentives and offset the rising cost of living. Tax credits have since stayed at the forefront of legislative efforts aimed at bolstering effective anti-poverty tools and have garnered further support following the success of the 2021 expanded federal Child Tax Credit (CTC), which was passed during the height of the COVID-19 pandemic to support families at a time of economic uncertainty. Unfortunately, the expanded tax credit expired in just a year, causing a huge spike in the rate of child poverty.

Since then, states have made significant strides in enacting and expanding local tax credits across the country. However, even as the momentum behind tax credits grows, millions of filers and families continue to miss out on claiming essential funds that can be used for basic necessities like housing, food, and utilities. Our partners at the Center on Budget and Policy Priorities (CBPP) and the Equity Opportunity Funders Network (EOF) recognize that the public awareness gap still exists and work alongside us to ensure that all households have the tools and resources needed to access these critical tax credit programs.

Solution

Through TCWF, Hatcher works with tax credit advocates at the federal and state levels to develop strategic communications plans and materials that promote the EITC, CTC, and the Child and Dependent Care Tax Credit (CDCTC).

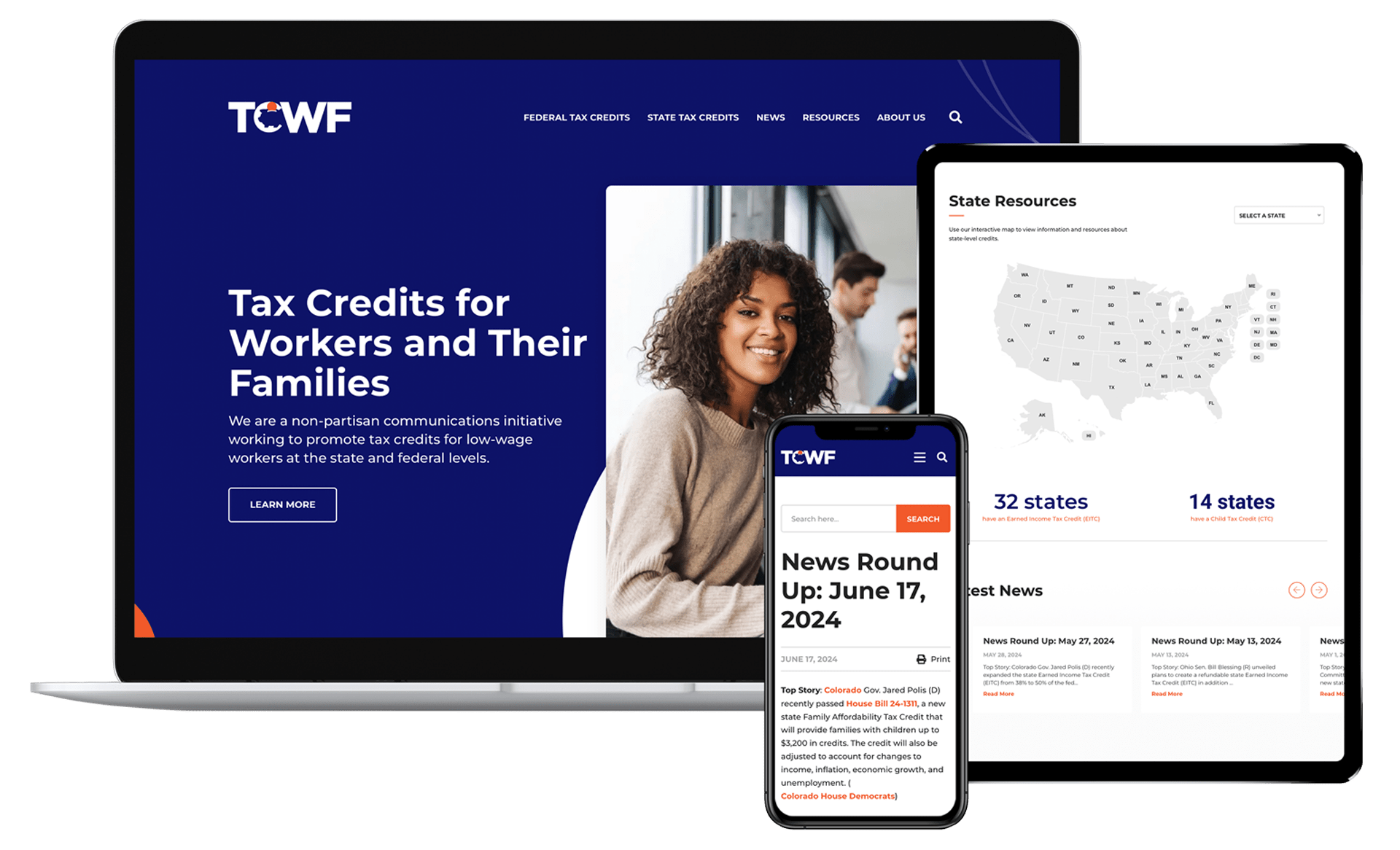

Developing a website that is a wealth of information

Hatcher was first selected to build and manage a website dedicated to providing comprehensive news and information regarding federal and state tax credits, which consisted of updating the site’s federal and state-designated pages to reflect local legislation and share the importance of enacting and expanding tax credits.

Creating communications tools for transformation

In partnership with the Center on Budget and Policy Priorities and the Equity Opportunity Funders Network, our role then expanded to include a full-scale communication campaign dedicated to providing communication assistance to state affiliates, developing advocacy materials, drafting and disseminating weekly news reports on recent tax credit updates, and heading social media campaigns. Our ongoing management of the TCWF initiative combines Hatcher’s capabilities in the community and opportunity sector with policy and advocacy communications expertise to ensure that everyone has the necessary tools and resources needed to thrive.

Decreasing poverty by increasing awareness

The TCWF team drafts and sends out weekly e-newsletters focused on federal and state-level tax credit updates, which is then cross-posted on the Hatcher-managed TCWF website. Our monthly blog posts are also dedicated to bringing awareness to the significance of enacting, expanding, and claiming tax credits, particularly among underrepresented communities, including immigrant filers. We also maintain all 50 state pages, which highlight the current tax credit legislative statuses and benefits for each state. These resources and information are shared across TCWF’s social platforms—X (formerly Twitter) and Facebook—to heighten public awareness and stay engaged with the broader discussion about decreasing poverty in the United States and the proven effective ways to do so.

Making an impact at the state level

We have also worked closely with state affiliates to provide testimonial support and craft materials that promote local tax credits. We collaborated with the Florida Policy Institute (FPI) to create a microsite about the “Working Floridians Tax Rebate,” their state EITC. The site was created to increase public awareness of the proposed tax credit and implore policymakers to progress the tax policy to support all Floridian workers and their families.

Impact

We compile recent news and research surrounding the federal and state tax credits, which are cross-posted on our website and in our weekly e-newsletters, which go to 1,290 recipients comprising policymakers, advocacy organizations, and community groups. In addition to our news roundups, we have published more than 20 blog posts dedicated to more in-depth analyses highlighting the benefit of progressing federal and state tax credits for a wide range of communities. In 2023, the website generated more than 80,000 page views and had a 24.78% decrease in bounce rate compared to the prior year.

Capabilities

Animation

Audio

Branding

Content

Earned media

Events: virtual

Graphic design

Strategic communications

Visual (video and photo)

Website: development